NEWS

The market development of chlorantraniliprole from the perspective of patent portfolio

Time of issue:

2021-12-28 12:11

Chlorantraniliprole is DuPont's top-selling product and the world's top insecticide, and it has successfully replaced thiamethoxam in its leading position. Chlorantraniliprole, the ryanodine receptor activitor, is the first active ingredient in insecticidal anthranilic diamides, which can widely and efficiently control chewing mouthparts pests in fruit trees, vegetables, field crops, special crops and lawns. In addition to controlling Lepidopteran pests, chlorantraniliprole can also control Colorado beetles and leafhoppers with increased dosage, and at the same time, it can also inhibit whiteflies.

Since its launch in 2008, chlorantraniliprole has been sold in more than 100 countries in the world, covering almost all major markets. Soybeans, fruits and vegetables are its main crop markets. At the same time, the product has also gained a large market share in cotton and rice. As a seed treatment formulation, chlorantraniliprole has been registered and marketed in the United States, Brazil, Japan, India, Myanmar, Mexico and Argentina, and is used in crops such as rice, corn, soybeans, and cotton.

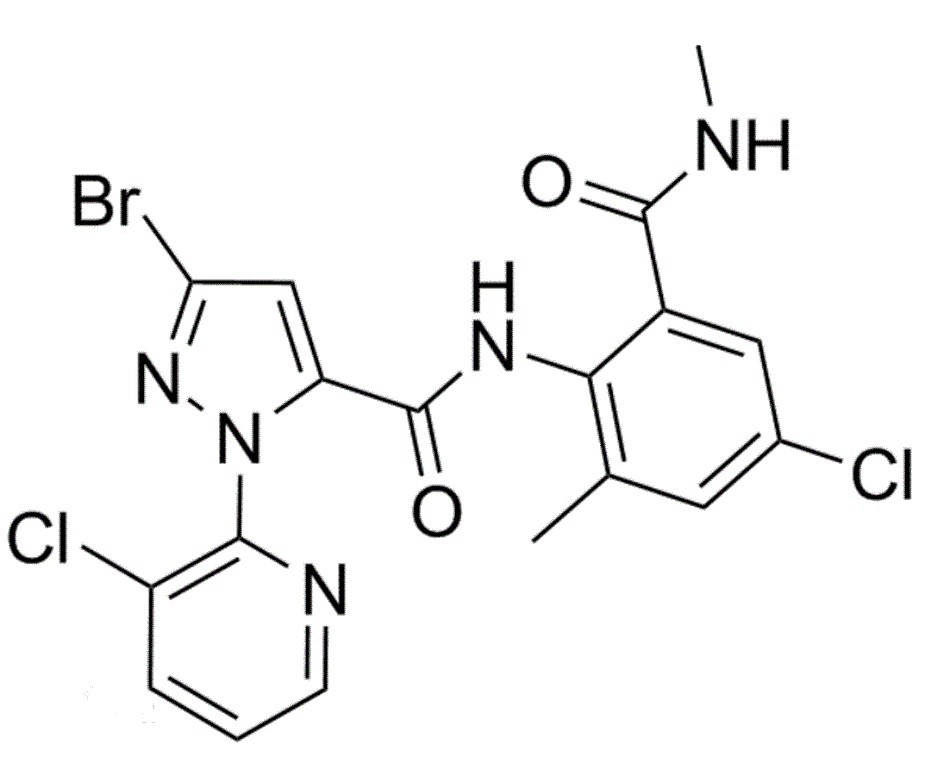

Chemical Structure

Patent information

Most of the patents for chlorantraniliprole compounds expired in March 2021:

World Intellectual Property Office (WO0170671):2001.3.20-2021.3.19;

Europe (EP1265850) 2001.3.20-2021.3.19;

US (US6747047) 2001.3.20-2021.3.20;

China (CN1419537B, CN1419537A) 2001.3.20-2021.3.19.

Current Chinese patents

|

No. |

Title |

Estimated Expiration Date |

Patent Applicant |

|

CN1051455838 |

Chlorantraniliprole microcapsule and preparation method thereof |

2035-09-01 |

ICCAS |

|

CN1043969748 |

A pesticide composition containing thifluzamide and chlorantraniliprole and its application |

2034-11-18 |

Institute of Plant Protection and Quality safety of Agricultural Products, Anhui Academy of Agricultural Sciences |

|

CN1043043208 |

A sugarcane insecticidal composition containing Coragen |

2034-09-05 |

Yang Xinlan |

|

CN1042221568 |

Sugarcane insecticide granules containing Coragen and humic acid |

2034-09-05 |

Yang Xinlan |

|

CN1037191488 |

Insecticidal composition containing chlorantraniliprole |

2033-12-30 |

Yang Jinlian |

|

CN1028051058 |

A pesticide composition containing Bacillus thuringiensis and chlorantraniliprole |

2032-07-23 |

Guangdong Zhongxun Agricultural Science Co., Ltd. |

|

CN1027264108 |

A pesticide composition containing chlorantraniliprole and tolfenpyrad and its application |

2032-07-12 |

Jiangsu Rotam Chemical Co., Ltd. |

|

CN1034938168 |

Compound pesticide composition containing spirodiclofen and chlorantraniliprole and its formulation |

2032-06-12 |

Yong Nong Biological Science Co., Ltd. |

|

CN1025505738 |

Chlorantraniliprole and rotenone compound suspension concentrate and preparation method thereof |

2032-01-30 |

South China University of Technology |

|

CN1025781618 |

Chlorantraniliprole and natural pyrethrin compound suspension concentrate and preparation method thereof |

2032-01-18 |

South China University of Technology |

|

CN1030535348 |

A kind of synergistic insecticidal composition containing tolfenpyrad and chlorantraniliprole and its application |

2031-10-18 |

Nanjing Huazhou Pharmaceutical Co., Ltd. |

|

CN1023792908 |

Ultra-low dose aqueous solution containing chlorantraniliprole |

2031-09-13 |

Guangxi Tianyuan Biochemistry Co., Ltd. |

|

CN1022658998 |

Compound pesticide containing chlorantraniliprole and phosemet and preparation method thereof |

2031-08-11 |

Hubei Xianlong Chemical Co., Ltd. |

|

CN1023186108 |

A seed treatment agent composition containing chlorantraniliprole and its application |

2031-07-25 |

Wu Yuanlin |

|

CN1024849948 |

Synergistic composition of matrine and chlorantraniliprole |

2030-12-02 |

South China University of Technology |

|

CN1019718308 |

Chlorantraniliprole and rotenone compound insecticidal water dispersible granules and preparation method thereof |

2030-10-20 |

South China University of Technology |

|

CN1019718298 |

Chlorantraniliprole and azadirachtin compound water dispersible granules and preparation method thereof |

2030-10-20 |

South China University of Technology |

|

CN1019718668 |

Chlorantraniliprole and natural pyrethrin compound insecticidal microemulsion and preparation method thereof |

2030-10-20 |

South China University of Technology |

|

CN1021135168 |

Insecticidal mixture containing chlorantraniliprole |

2030-01-05 |

Hainan Zhengye Zhongnong High-tech Stock Co., Ltd. |

|

CN1016694888 |

Compound insecticide containing chlorantraniliprole |

2029-09-29 |

Jingbo Agrochemicals Technology Co., Ltd. |

Patent portfolio of multinational corporations

Chlorbenzamide has attracted much attention in recent years, because two Chinese patents for protecting core compounds are expected to expire on August 13th, 2022, so it has been closely watched by domestic enterprises and ushered in a wave of registration boom.

It is worth noting that even if the core compound patent expires, domestic enterprises can't act rashly. Let's take a look at the patent protection system of this product. In addition to focusing on core compound patents in 26 countries/regions around the world, DuPont has also improved its patent portfolio, such as the patent of the same series of compounds, which blocked the possibility of many derivatives based on core group structure. Moreover, DuPont has also formulated a series of peripheral patent portfolios around mixtures and uses, and completed a full range of patent protection, extending the patent protection period as much as possible, and protecting DuPont's profits as a technical manufacturer to the greatest extent.

Registration in China

In 2008, DuPont's chlorantraniliprole was launched, which brought huge profits to DuPont. In addition to DuPont, Syngenta, Beixing and Arysta are all engaged in market development of this product. Now, FMC has taken over chlorantraniliprole as a whole from DuPont.

Regarding the registration of technical, at present, four enterprises in the Chinese market have obtained registration of chlorantraniliprole TC, of which the total content registered by Rainbow is 98%, and the total content registered by FMC, DuPont, and Miraculous is 95.3%.

Although chlorantraniliprole is still in the patent period at present, domestic preparation enterprises have started to register.

Among them, the main registered dosage forms of single dose are granules and suspension concentrate:

It should be noted that Syngenta has applied chlorantraniliprole for sanitary use, and it is also the first domestic sanitary use registration of chlorantraniliprole.

At present, there are 37 registered chlorantraniliprole mixtures in China, of which 8 belong to Syngenta, and the rest belong to domestic enterprises. Thiamethoxam, Emamectin benzoate, Monosultap and Pymetrozine are the main Components of its mixtures, and the mixture can also solve the problem of high resistance of chlorantraniliprole at present.

Intellectual Property Protection in China

Since chlorantraniliprole is still in the patent period, domestic companies cannot produce without authorization, so some domestic manufacturers have added domestic Coragen as a hidden ingredient in their products, and add the words related to "KK", which proves that it has added Coragen. At the time when domestic Coragen was most proliferating, DuPont started to crack down on counterfeiting in 2011, investigating domestic products with hidden ingredients and defending rights.

Manufacturers who have added chlorantraniliprole have published newspapers to apologized one after another. In recent years, a series of patent infringement cases between FMC and domestic companies are all related to chlorantraniliprole.

Resistance

The large-scale use of chlorantraniliprole will inevitably produce resistance. Since 2011, the diamondback moth has developed resistance to Coragen in some areas of southern China. By 2014, almost all Lepidoptera pests in the southern vegetable area had developed resistance to chlorantraniliprole.

Chlorantraniliprole has a brand-new target, and its sensitivity is not easy to decrease in the first 2 years of application, and it also maintains a high control effect at the recommended dose, but then the sensitivity decreases faster.

However,in the face of severe resistance of chlorantraniliprole, some traditional insecticides have reappeared in people's sight, among which indoxacarb, lufenuron, and chlorfenapyr are the hottest alternative products. Although resistance is fierce, the revolutionary significance of chlorantraniliprole in the history of pesticides cannot be ignored. The main reason for the development of resistance is still due to the low level of pesticide application by farmers. Rotation of pesticides, rational application of pesticides and crop rotation can effectively avoid or delay the development of resistance.

Future trend

Since its launch, Chlorantraniliprole's sales have increased almost year by year, and climbed to a historical high of $1.48 billion in 2014. The compound annual growth rate from 2009 to 2014 was as high as 46.4%.

Soybean is the largest market for chlorantraniliprole, with sales of $351 million in 2016, accounting for 25.7% of the global market. Rice is the second largest market for chlorantraniliprole, with sales of $134 million in 2016, accounting for 9.8% of the global market and 7.9% of the US$1.693 billion rice pesticide market. Cotton ($79 million, accounting for 5.8%), corn ($44 million, accounting for 3.2%), pears ($38 million, accounting for 2.8%), grains ($21 million, accounting for 1.5%), potatoes ($18 million,accounting for 1.3%), sugarcane ($15 million, accounting for 1.1%) are also important markets for chlorantraniliprole.

Although the sales of chlorantraniliprole have declined in the past two years, due to its excellent product performance, continuously developed compounding formulations, and continuously tapped new markets (such as seed treatment, non-agricultural use, etc.),its market still has growth potential in the future, which will still defend its dominance in the global pesticide market.

LANGUAGE

LANGUAGE